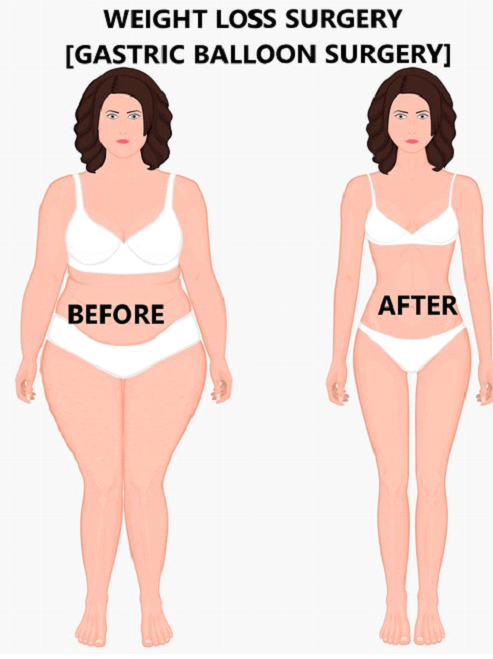

Weight loss Surgery is Something everyone wants to achieve, but it can be challenging to do without the help of a surgeon. Fortunately, many insurance companies cover weight loss surgery if specific criteria are met. When considering whether to undergo a procedure, you should speak with your provider to see what your specific policy covers and the factors they consider when deciding eligibility for coverage.

Numerous weight loss procedures are frequently covered by insurance. These include:

⦁ Gastric Bypass Surgery: Roux-en-Y gastric bypass includes forming a tiny pouch at the top of your stomach and guiding the small intestine to this pouch.

⦁ Laparoscopic Adjustable Gastric Banding (LAGB): This surgery entails creating a tiny pouch by wrapping an inflatable band over the top section of your stomach above the band with the remaining stomach below the band.

⦁ Sleeve Gastrectomy: This procedure involves removing part of your stomach, which leaves a tubular pouch that resembles a banana.

⦁ Biliopancreatic Diversion with Duodenal Switch (BPD/DS) Gastric Bypass: This more complex surgery bypasses a significant portion of the small intestine, reducing the calories and nutrients the body absorbs.

Insurance coverage for these surgeries can vary depending on your insurance provider and a specific plan. It’s essential to consult with your insurer and healthcare provider to understand which procedures are covered under your particular plan.

Factors Insurance Providers Consider for Weight Loss Surgery Coverage

Medical Necessity

The first factor that insurance providers consider is whether the weight loss surgery is medically necessary. As a general rule, insurance companies require a Body Mass Index (BMI) of 40 or higher, a BMI of 35 or higher, or an illness linked to obesity, such as sleep apnea, diabetes, or heart disease.

Prior Weight Loss Efforts

Insurance providers often want a history of failed weight loss efforts before considering covering weight loss surgery. This may include participating in supervised weight loss programs, dietitian consultations, or other medically supervised attempts.

Psychological Evaluation

Many insurance companies require a psychological evaluation to determine whether the patient will likely adhere to dietary and lifestyle changes after surgery. This is because weight loss surgery is not a cure for obesity but rather a tool to assist with weight loss.

Physician Recommendation

A formal recommendation from a physician indicating the medical necessity of the surgery is often required. This typically includes a comprehensive medical evaluation and documentation of the patient’s obesity-related health conditions.

Surgery Center Accreditation

Lastly, insurance providers tend to cover surgeries only when performed at accredited facilities with a track record of successful outcomes and low complication rates. This means that the choice of the surgery center can impact whether your procedure is covered.

Remembering that each insurance company may have different requirements and considerations is critical. Therefore, it’s essential to have detailed discussions with your insurance company and healthcare provider about your unique circumstances.

Average Cost of Weight Loss Surgery and Financing Options

When considering weight loss surgery, it’s essential to understand the costs involved. The average cost of weight loss surgery in the United States ranges from $15,000 to $25,000, depending on the type of surgery. This price typically includes hospital fees, surgeon fees, anesthesia, and follow-up care costs.

However, the cost can significantly vary based on regional pricing differences, surgical practice, and whether any complications or additional procedures are necessary. For instance, Gastric Bypass Surgery tends to be on the higher end of the price range, while Laparoscopic Adjustable Gastric Banding is typically less expensive.

Understanding your financing options is critical to making your weight loss surgery affordable. If your insurance provider doesn’t cover the procedure or if you are uninsured, there are still several ways you can finance your surgery:

⦁ Payment Plans: Many hospitals and clinics offer in-house payment plans. These plans allow you to pay for your surgery in installments over time, often with little to no interest.

⦁ Medical Loans: Several financial institutions offer loans specifically designed to cover medical procedures. These loans often have competitive interest rates and flexible repayment terms.

⦁ Credit Cards: Some patients pay for surgery using a low-interest credit card. This option can be viable, especially if you can pay off the balance quickly.

⦁ Healthcare Savings Accounts (HSAs) or Flexible Spending Accounts (FSAs): If you have an HSA or FSA, you may use these funds to pay for your surgery.

⦁ Crowdfunding: Websites like GoFundMe have made it possible to raise money for medical procedures through crowdfunding. This involves requesting donations from friends, family, or even strangers to help cover your surgery costs.

Remember, the financing choice should consider your financial situation and repayment ability. Conversation with a financial expert or counselor who can guide the process and make the most informed decision is advisable.